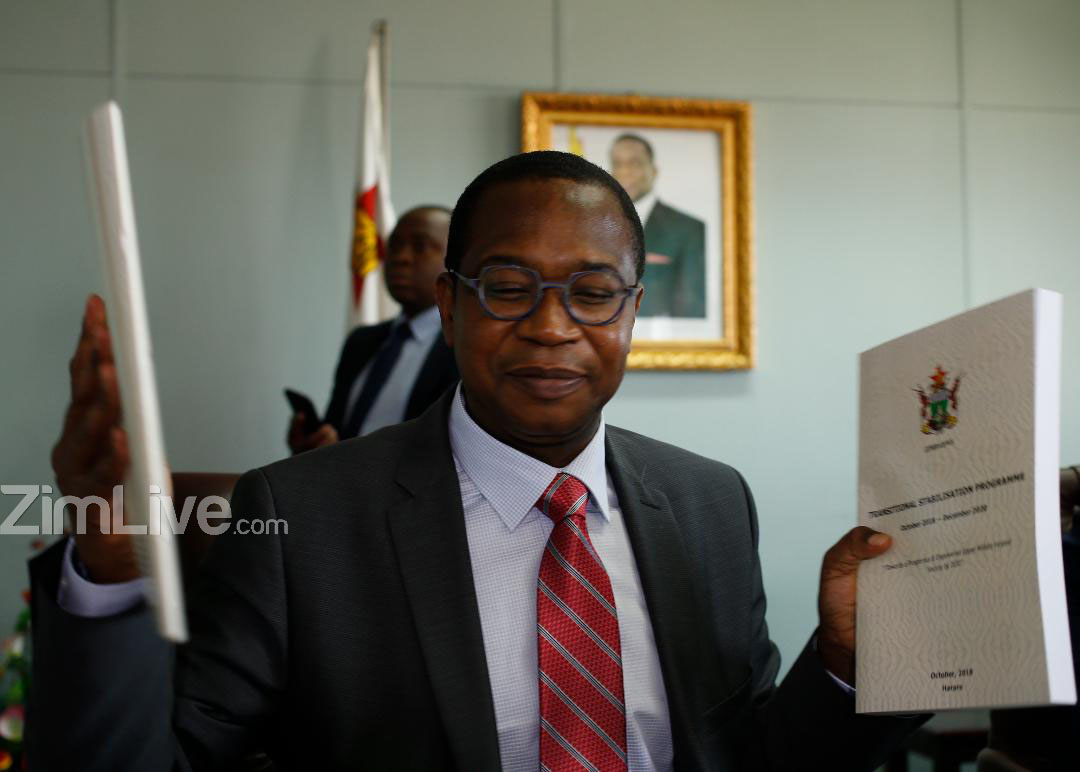

HARARE – Finance Minister Mthuli Ncube, in his latest bid to quell economic carnage triggered by a shock new tax on money transfers and a directive to banks which undermined the bond note surrogate currency, on Wednesday maintained that all RTGS bank balances will be preserved on a par with the United States dollar.

The government will also be publishing regulations protecting foreign currency deposits from being raided by the government and the central bank, the minister said.

The bond note’s value has plunged since the October 1 announcement of a 2 percent tax on money transfers, and the splitting of bank accounts into foreign currency accounts and RTGS/bond note accounts.

Business condemned the tax, which they said would eat into their profits. Price increases shortly followed and fearing the loss of savings, Zimbabweans have been offloading their bond notes on the black market further devaluing the surrogate currency. The bond note was 1:3.6 against the dollar on Wednesday on the parallel market.

Ncube, in a statement, responded directly to calls for the bond note to be abandoned, saying he had set in motion plans for a “strong and sustainable currency reform system.”

But before that can be implemented, he said certain economic reforms needed to be undertaken.

“It is critical to restate the government’s great commitment to reducing fiscal imbalances which are the root cause of the many challenges the economy is facing,” Ncube said, singling out the cash shortages and the proliferation of foreign exchange parallel market rates which have a negative effect on prices.

“These challenges require that government position the economy on a strong footing by implementing reforms that include cutting on government expenditure; working towards an import parity pricing system; increasing efficiency on government delivery systems and fast-tracking the state-owned enterprises reforms, among a host of reforms.

“These reforms shall be accompanied by a strong and sustainable currency reform system which will follow after the execution of the above reforms. This is necessary to ensure that any currency reform programme that the government would put in place is effective and that it has minimum disruption to business,” Ncube said.

Zimbabwe would continue to use the multi-currency system which was put in place in 2009 when the government finally abandoned the Zimbabwe dollar, he said.

“This system entails that foreign exchange earners are not prejudiced of their regulatory foreign exchange receipts and that those who do not earn foreign exchange have access to foreign exchange through the banking system as is per the current policy of foreign exchange management system. In parallel, the Reserve Bank shall continue to maintain adequate resources for the import of essential commodities,” the minister went on.

“Over and above the Nostro Deposit Protection Guarantee from Afreximbank, we are also reinforcing Nostro foreign currency accounts with a statutory instrument to guarantee that these are private deposits, and neither the Reserve Bank nor government has any access to them.

“The government recognises concerns surrounding RTGS deposits, and we commit to preserve the value of these balances on the current rate of exchange of 1 to 1, in order to protect people’s savings.”