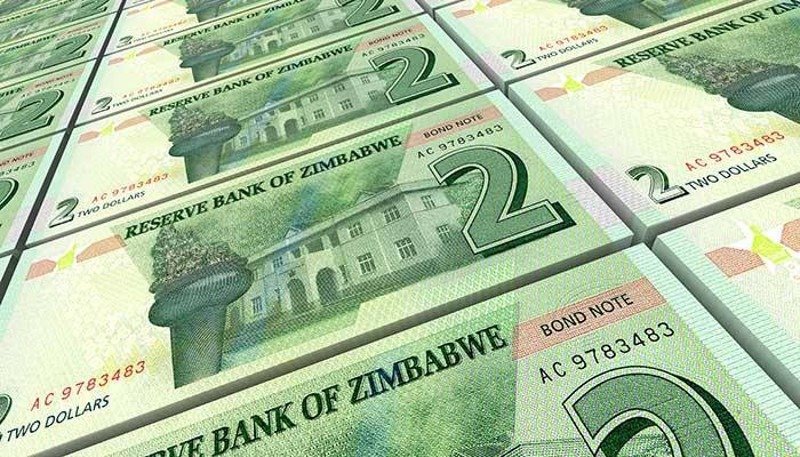

HARARE – The Reserve Bank of Zimbabwe says it is turning on the printing press for ZW$400 million worth of new bond notes to fill the gap after multi-currencies were banned as legal tender.

Last week, the government renamed its interim currency, the RTGS dollar, the Zimbabwe dollar and made it the country’s sole legal tender, ending a decade of dollarisation and taking another step toward relaunching a fully-fledged currency.

Reserve bank governor John Mangudya told parliament’s budget and finance committee on Monday that the new currency measures had “created a gap”, with physical notes of the local currency in short supply.

“By printing the ZW$400 million, we are saying there is need for increase in paper money to replace the gap created by non-usage of foreign currency and we are saying the ZW$400 million will be on a drip-feed basis. And as we print new money, it will also replace the old dirty notes,” Mangudya said.

Finance Minister tried to allay the MPs’ fears that the RBZ could go on a money printing spree, returning the country to the 2008 when excessive printing fuelled inflation and eventually led to the demise of the Zimbabwe dollar a year later.

“In 2008, we had fiscal indiscipline and we are far from that as our policies and conditions are different. I don’t think we are repeating the same thing. We’re in a far better position than then. I would like to assure you that we’re not in 2008 where we had a number of zeroes compared to now. It’s about policies and we’re in a different policy environment,” Ncube insisted.

Meanwhile, Mangudya said on Monday individuals and companies hold US$1.3 billion in foreign currency accounts.

Individuals will be allowed to withdraw up to US$1,000 in cash a day from foreign currency accounts, but companies and non-governmental organisations will get the ZW$ equivalent on withdrawals, calculated at the prevailing interbank rate.

In May, President Emmerson Mnangagwa’s government agreed a staff-monitored programme with the International Monetary Fund to help Zimbabwe implement coherent economic policies.

But a hoped-for turnaround is yet to materialise, and many Zimbabweans are distrustful of Mnangagwa’s promises.