HARARE — More than 50 haulage trucks laden with white cement have been held up at the Chirundu Border Post after the Zimbabwe Revenue Authority (ZIMRA) began enforcing a newly introduced 30 percent surtax on imports, Augutich Investments (Pvt) Ltd told the High Court in Harare on Thursday.

In an urgent chamber application filed under case number HCH2500/25, Augutich argues that the surtax, introduced via Statutory Instrument 50A of 2025 on May 16, directly contradicts existing trade rules under the Customs and Excise (Common Market for Eastern and Southern Africa) (Suspension) Regulations, 2000, which exempt goods imported from fellow COMESA member states from duties and surtaxes.

ZIMRA began collecting the levy on May 21, the company says, even on consignments purchased and in transit before the amendment took effect.

The retroactive application, Augutich contends, amounts to an “unlawful and unconstitutional” financial burden.

“Sometime in the year 2000, the respondent caused the promulgation of Customs and Excise (Common Market For Eastern And Southern Africa) (Suspension) Regulations, 2000, which provide for the exemption of duty / surtax on goods imported and exported between member states of the Common Market For Eastern And Southern Africa hereinafter referred to as ‘COMESA or The COMESA regulations,’” wrote Augutich CEO Levy Mashingaidze in his founding affidavit.

He added, “With the coming into effect of the COMESA regulations and with the passage of time, the applicant being an importer of white cement and other cement related product would over the years import cement from Zambia for purposes of resale in Zimbabwe. With Zambia being a COMESA member state, the applicant would import the cement duty or surtax free in accordance with the COMESA regulations.”

Augutich began importing cement from Zambia in 2020 under a Ministry of Industry and Commerce licence, most recently valid through February 2025, the affidavit states. In September 2024, the firm purchased 70,000 tonnes of cement from Chilanga Cement Plant in Zambia.

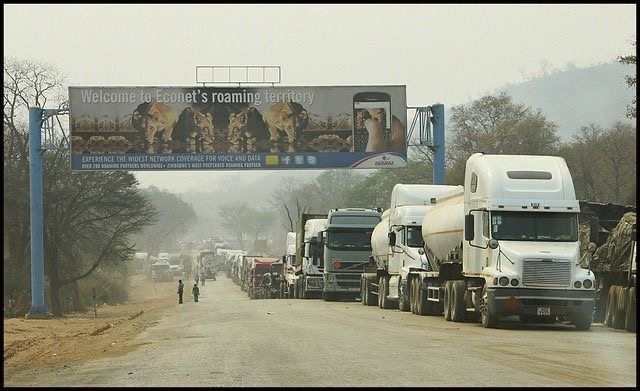

“The applicant has over 50 haulage trucks now stuck at Chirundu Border Post due to unforeseen tax obligations,” Mashingaidze said. “The hired trucks are charging demurrage of US$200 per day per truck due to the delays. This amounts to approximately US$10,000 per day.” He warned that if the levy is not suspended, Augutich could incur US$2.9 million in additional costs over the next year.

In a certificate of urgency, lawyer Gift Nyandoro of Hamunakwadi and Nyandoro Law Chambers argued that the retrospective enforcement violates fundamental legal principles. “The law is being applied with retrospective effect. The applicant has no other remedy than to seek this court’s intervention to suspend the implementation of the new surtax on cement already purchased,” Nyandoro wrote.

Augutich is seeking two key orders from the High Court which are a temporary interdict preventing ZIMRA from enforcing the 30% surtax on cement already in transit or purchased before May 16, 2025.

The company is also seeking a final declaration that SI 50A of 2025 is inconsistent with Zimbabwe’s COMESA obligations and therefore invalid.

The Ministry of Finance, Economic Development and Investment Promotion—named as the respondent—has not yet filed a formal response.

Government officials have previously defended the surtax as a measure to protect domestic cement producers from cheap imports, but critics say the abrupt change undermines investor confidence and regional integration while at the same time driving up local construction costs and disrupting the entire building materials market.